Contributing capital, buying shares of Vietnam enterprises is one of the investment forms that foreign investors can select when they want to invest in Vietnam.

Contributing capital, buying shares of foreign investors in enterprises in Vietnam

1. The procedure for contributing capital and buying shares of enterprises in Vietnam for foreign investors.

Basically, investors who want to buy contributed capital or shares of a Vietnamese enterprise need a 2-step procedure as follows:

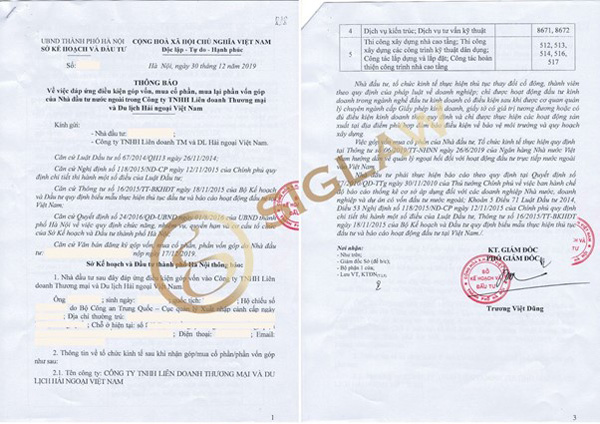

Step 1. Register to buy contributed capital, shares of Vietnam enterprises

Applications include:

-

Documents register for contributing capital, buying shares, buying contributed capital.

-

Copy of legal documents of individuals, organizations contributing capital, buying shares, buying contributed capital and the economic organization with foreign investors that contribute capital, buy shares, and buy contributed capital.

-

Agreement on capital contribution, buying shares, buying contributed capital between foreign investors and the economic organization receiving contributed capital, or bought shares.

-

Licensing agency: Department of Planning and Investment.

-

Estimated time: 10 working days.

Step 2. Change the business registration information

-

If foreign investors buy the contributed capital from a limited liability company, the enterprise needs to implement the procedure for changing the Certificate of Business Registration at the Department of Planning and Investment.

-

If foreign investors buy shares of a joint-stock company, it is necessary to implement the procedure for notifying shareholders as foreign investors with the Department of Planning and Investment.

Step 3: Make amendment to the Investment Registration Certificate (if any)

It can be seen that investing in the form of buying contributed capital and shares of foreign investors of Vietnam enterprises is quite simple, the procedure is not too complicated.

Moreover, foreign-invested enterprises have already had a foundation and advantages in the previous operation as well as a stable system of personnel, facilities, and customers... These are the advantages of this investment form compared to establishing a foreign-invested enterprise. This form will be suitable for new foreign investors and small investments in Vietnam.

2. Legal basis

-

Law on Investment 2020

-

Law on Enterprises 2020

-

Decree No. 31/2021/ND-CP dated March 26, 2021 on elaboration of certain articles of the Law on Investment.

-

Decree No. 01/2021/ND-CP dated January 01, 2021 on enterprise registration.

For comprehensive support, please contact:

Siglaw legal company limited (Siglaw Firm)

Hotline: +84 967 818 020

Headoffice in Hanoi:

Address: No. 44/A32 - NV13, Glexemco A, Le Trong Tan Street, An Khanh Ward, Hoai Duc District, Hanoi City, Vietnam

Email: hanoi@siglaw.vn

Branch in Central Area:

Address: 177 Trung Nu Vuong Street, Hai Chau District, Da Nang, Vietnam

Ho Chi Minh City Branch:

Address: A9.05 BLOCK A, SkyCenter Building, 5B Pho Quang Street, Ward 2, Tan Binh District, Ho Chi Minh City, Vietnam

Email: hcm@siglaw.vn