The investor must implement the procedure to adjust the Investment Registration Certificate at the Investment Registration Authority in accordance with the Law on Investment 2020. The Investment Registration Authority will return the results within 15 working days from the receipt of a valid application.

1. Cases require adjustments of the investment registration certificate

The investor shall follow the procedure for adjusting the investment registration certificate if the adjustment to the investment project changes any content of the investment registration certificate, including:

-

Change the investor information.

-

Change the business information.

-

Change the information about investment projects related to objectives and scale.

-

Change the location of the investment project.

-

Change the form of the investment project.

-

Change the investment capital.

-

Change the duration of the investment project.

-

Change the investor information, change the investor.

Seemingly, the investor can change most of the information on the Investment Registration Certificate except for the tax identification number/ business code.

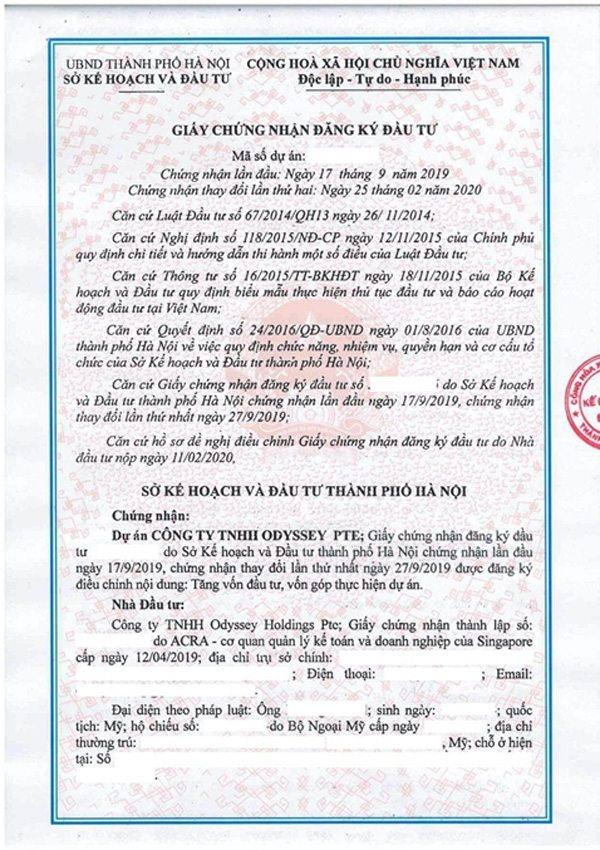

Client’s Investment Registration Certificate applied and adjusted by Siglaw Firm

2. Application for the adjustment of Investment Registration Certificate

-

Application for the adjustment of Investment Registration Certificate include:

-

An application form for the adjustment of the investment project.

-

A report on an investment project’s progress by the time of adjustment.

-

The investor’s decision on investment project adjustment if the investor is an organization.

-

Explanation or documents relating to the adjustment.

Enterprises should carefully prepare applications according to regulations before submitting to the regulatory agencies to avoid the rejection of the application, leading to a waste of time, effort and money of the company.

Adjustment of the Investment Registration Certificate is a compulsory procedure when the enterprise changes its information of investment project’s information

3. Regulatory agencies for the adjustment of Investment Registration Certificates

Law on Investment 2020 regulates that the Department of Planning and Investment and the Management Boards of industrial zones, export-processing zones, hi-tech zones and economic zones have the authority to adjust the investment registration certificate.

-

Departments of Planning and Investment of provinces where investment projects are executed or where operating offices are located or expected to be located for execution of investment projects shall issue, adjust and revoke investment registration certificates of the following investment projects:

-

Investment projects executed in 02 provinces or more.

-

Investment projects executed inside and outside industrial parks, export-processing zones, hi-tech zones and economic zones.

-

Investment projects executed inside industrial parks, export-processing zones, hi-tech zones and economic zones where management boards of such industrial parks, export-processing zones, hi-tech zones and economic zones have yet to be established or not under the management of the management boards of industrial parks, export-processing zones, hi-tech zones and economic zones.

-

Management boards of industrial parks, export-processing zones, hi-tech zones and economic zones shall issue, adjust and revoke investment registration certificates with regard to the investment projects.

-

Industrial park, export-processing zone, hi-tech zone and economic zone management boards shall issue, adjust and revoke investment registration certificates of the following investment projects.

-

Projects on investment in and commercial operation of infrastructure in industrial parks, export-processing zones, hi-tech zones and economic zones;

-

Investment projects executed inside industrial parks, export-processing zones, hi-tech zones and economic zones.

4. Steps to implement the procedure of adjusting Investment Registration Certificate

Step 1: Implement the procedure of adjusting and issuing Investment Registration Certificate according to investment procedure.

Within 15 days from the receipt of the valid application, the investment registration authority shall adjust the Investment Registration Certificate; in case of rejection of the application, a written explanation shall be provided to the investor.

Step 2: Adjust relevant content on the Certificate of Enterprise Registration and post its information on the National Business Registration Portal.

In case the adjustment of the Investment Certificate changes relevant information in the Business Registration Certificate, the investor must implement procedures to change the business registration in accordance with the provisions of the Law on Enterprises 2020.

5. Legal basis:

-

Law No. 61/2020/QH14 of the National Assembly on June 17, 2020

-

Decree No. 31/2021/ND-CP of the Government on March 26, 2021, Elaboration of some articles of the law on investment

For comprehensive support, please contact:

Siglaw legal company limited (Siglaw Firm)

Hotline: +84 967 818 020

Headoffice in Hanoi:

Address: No. 44/A32 - NV13, Glexemco A, Le Trong Tan Street, An Khanh Ward, Hoai Duc District, Hanoi City, Vietnam

Email: hanoi@siglaw.vn

Branch in Central Area:

Address: 177 Trung Nu Vuong Street, Hai Chau District, Da Nang, Vietnam

Ho Chi Minh City Branch:

Address: A9.05 BLOCK A, SkyCenter Building, 5B Pho Quang Street, Ward 2, Tan Binh District, Ho Chi Minh City, Vietnam

Email: hcm@siglaw.vn